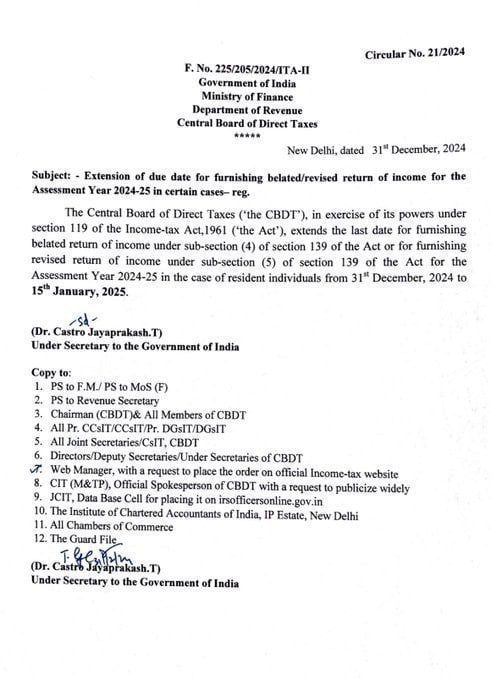

CBDT Extends Deadline for Furnishing Belated / Revised ITR for AY 2024-25 to 15th January 2025

In a significant relief to taxpayers, the Central Board of Direct Taxes (CBDT) has extended the deadline for furnishing belated and revised Income Tax Returns (ITR) for the Assessment Year (AY) 2024-25.

The new deadline is now set to 15th January 2025, providing an additional two weeks beyond the original deadline of 31st December 2024

This extension applies to resident individuals who need to file their belated returns under Section 139(4) or revised returns under Section 139(5) of the Income-tax Act, 1961

The decision was made to offer taxpayers more time to comply with their tax obligations, ensuring they can accurately and thoroughly complete their returns without the pressure of the year-end deadline

Key Points:

- Extended Deadline: The new deadline for filing belated or revised ITRs for AY 2024-25 is 15th January 2025

- Applicable Sections: This extension is applicable under Section 139(4) for belated returns and Section 139(5) for revised returns of the Income-tax Act, 1961

- Reason for Extension: The extension aims to provide additional time for taxpayers to comply with their tax filing requirements

Taxpayers are advised to take advantage of this extension and ensure their returns are filed accurately to avoid any penalties. For those who miss this extended deadline, penalties of up to ₹5,000 may be imposed, with a reduced penalty of ₹1,000 for individuals with an income below ₹5 lakh.

For further details, taxpayers can refer to the official notification issued by the CBDT or consult with tax advisors @ hello@karnipuna.com

#CBDT #IncomeTax #TaxFiling #BelatedITR #RevisedITR #AY2024_25 #TaxDeadline #TaxExtension #IndiaTax #TaxCompliance